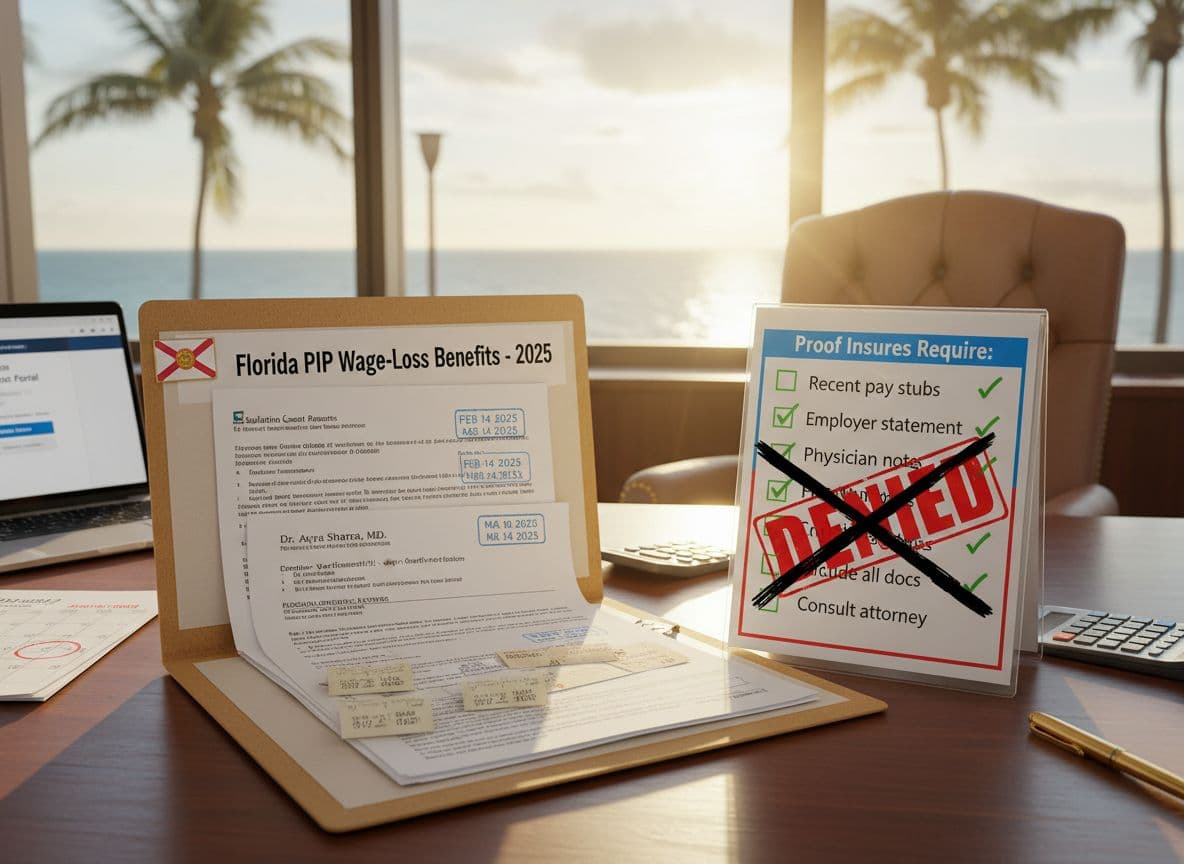

Florida PIP wage-loss benefits in 2025, what proof insurers ask for, and how to avoid a denial

Missing work after a car crash can feel like getting hit twice. First by the impact, then by the bills that don’t stop just because you can’t clock in.

In 2025, Florida PIP wage loss benefits can help, but insurers usually won’t pay until you give them a clean, consistent paper trail. The good news is that most wage-loss denials are avoidable when you know what adjusters look for and you build your claim like you’re proving it to a skeptical accountant, not a sympathetic neighbor.

How Florida PIP wage loss works in 2025 (the rules that matter)

Florida is still a no-fault state in 2025. That means your own Personal Injury Protection (PIP) coverage is often the first source of payment for accident-related medical bills and lost income, regardless of who caused the crash.

Here’s what wage-loss claimants need to keep in mind:

- PIP pays a percentage of lost income, not 100%. Under Florida’s PIP structure, wage loss is typically paid at 60% of lost gross income (subject to the overall PIP limit).

- PIP has a cap, commonly $10,000 total for combined PIP benefits (medical and wage loss together), depending on your policy terms and your medical classification.

- The 14-day medical rule can make or break your claim. If you don’t get medical treatment within 14 days of the crash, insurers often deny PIP benefits altogether.

- EMC status affects available PIP funds. If a provider does not diagnose an “emergency medical condition” (EMC), PIP medical benefits can be limited, which can change how quickly your PIP funds get used up.

If you want a plain-English overview of how no-fault works in real claims, see Florida automobile insurance basics and PIP wage loss.

What proof insurers ask for in Florida PIP wage-loss claims

Insurers don’t just want to know that you missed work. They want to know what you would’ve earned, what you actually earned, and why the gap is accident-related.

Think of your wage-loss claim like a three-part bridge:

- You had income before the crash.

- You lost income after the crash.

- A medical provider restricted you from working (or limited your work).

Common wage-loss documents (what adjusters routinely request)

| Your work situation | Proof insurers commonly ask for | Why they ask |

|---|---|---|

| W-2 employee (hourly or salary) | Recent pay stubs (often several weeks or months), W-2, employer wage verification form, time and attendance records | To confirm your pay rate, usual hours, and the exact dates missed |

| Overtime, shift differentials, bonuses, commissions | Pay history showing patterns (prior months or year-to-date), commission statements, employer explanation of how variable pay is calculated | To decide whether “extra” earnings are predictable enough to include |

| Self-employed | Prior tax return (Schedule C), profit and loss statement, invoices, bank deposits, client cancellations, business calendar | To separate business revenue from personal income and show the downturn timing |

| Gig worker (rideshare, delivery, freelance platforms) | App earnings screenshots or statements, 1099s, weekly summaries, bank deposits tied to platform pay | To prove consistent earnings and show the drop after the crash |

| Recently started a job | Offer letter, onboarding paperwork, first pay stub (if any), employer letter confirming scheduled hours and start date | To show the job was real and income loss wasn’t speculative |

Insurers also often ask you to sign forms, such as wage authorizations, so they can confirm details directly with your employer. If you’re self-employed, they may request broader financial records than you expect. It’s not personal, it’s how they test the claim.

Medical proof matters as much as payroll proof

A wage-loss file can look perfect financially and still get denied if the medical support is weak. Insurers look for a clear statement that your crash injuries kept you from doing your job duties.

Strong medical support usually includes:

- Work-status notes showing you were taken off work, put on light duty, or given reduced hours

- Specific restrictions (no lifting over 10 pounds, no prolonged standing, no driving, no repetitive bending)

- A date range for the restriction (start date and re-evaluation date)

- Connection to diagnosed injuries, not just pain complaints

If your job is physical, bring a short written list of tasks to your first appointments. If you sit at a desk, explain how symptoms affect sitting, typing, screen time, or commuting. The medical record needs to match your real work limits.

For a practical breakdown of how PIP claims flow from the start, review step-by-step PIP wage loss claim in Cape Coral.

The most common wage-loss denial reasons (and how to avoid them)

Most denials aren’t about whether you were hurt. They’re about missing links in the chain of proof.

Missed the 14-day treatment window

If you wait too long to see a provider, PIP can be denied. Go in early, even if symptoms seem minor. Soft-tissue injuries can worsen days later, and the deadline doesn’t care.

No doctor-imposed work restriction

“I couldn’t work” and “my doctor took me out of work” are not the same thing to an insurer. Ask your provider for a written work-status note and confirm it’s in the chart.

Wage documents don’t match your claim

If you claim you missed three weeks, but the employer record shows you worked part of that time, expect a denial or reduction. Be precise. If you tried to work but left early, document it and claim the difference.

Self-employed income is unclear

Many self-employed claims fail because people send only invoices or only a tax return. Insurers want both: historical earnings and real-world proof of the post-crash drop.

Delays and gaps

Long gaps in treatment or waiting weeks to submit wage forms can raise suspicion. Build the packet and send it as soon as you have enough documentation to support the dates claimed.

For more context on how wage loss fits into Florida’s no-fault structure, see Florida no-fault law: PIP wage loss protection.

A simple way to package your wage-loss claim (so it’s harder to deny)

A clean submission makes adjusters less likely to “kick it back” for missing pieces.

Before you send anything, assemble:

- A one-page timeline (crash date, first treatment date, off-work dates, return-to-work date or current status)

- Work-status notes covering each missed period

- Employer verification (letter or insurer form) confirming pay rate and time missed

- Pay proof (pay stubs, W-2, tax return, 1099, or platform statements)

- Your own written statement listing missed shifts or reduced hours (keep it factual and consistent)

If you have partial disability (reduced hours), include both what you earned before and after. PIP wage-loss claims often turn on the difference.

When PIP wage loss isn’t enough (and when to talk to a personal injury attorney)

Even a well-supported Florida PIP wage loss claim may not cover everything. PIP is limited, and serious injuries can burn through benefits fast.

It may be time to speak with a personal injury attorney if:

- Your wage-loss claim is denied, delayed, or repeatedly “pending more info”

- Your injuries keep you out of work beyond the short term

- You may qualify to pursue damages outside PIP because your injuries meet Florida’s serious injury threshold

- You need to coordinate other coverage (health insurance, short-term disability, uninsured motorist coverage, or a claim against the at-fault driver)

A strong case is built early, while records are fresh and employers can verify details without confusion.

Conclusion

Wage-loss benefits can be a lifeline after a crash, but insurers pay PIP wage claims only when the medical story and the money story match. Treat your wage-loss file like a tight record, not a casual request. Get medical care within 14 days, get clear work restrictions, and send payroll proof that supports the exact dates missed. When the stakes are high, protecting your Florida PIP wage loss claim early can prevent a denial that costs you months of income.