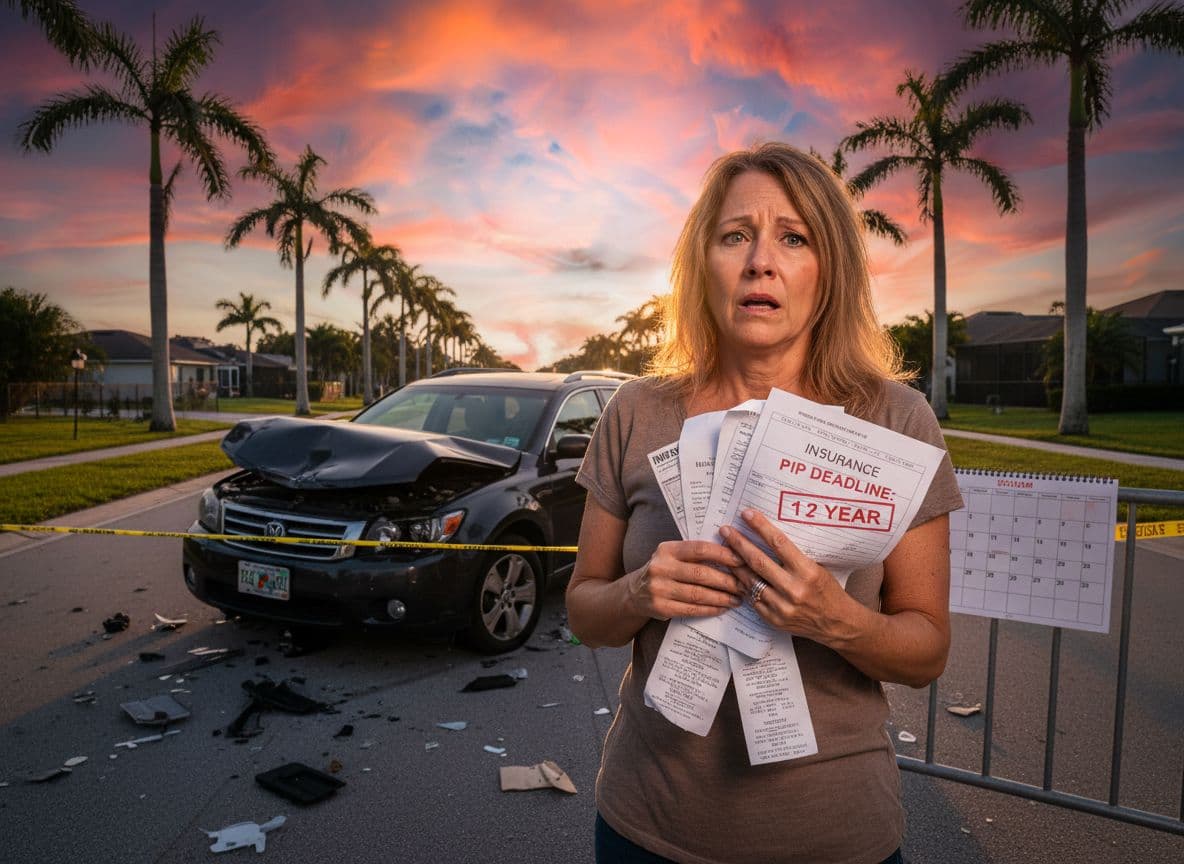

How Florida’s One-Year Deadline for PIP Benefits Catches Cape Coral Car Crash Victims Off Guard

You get rear-ended on Del Prado or Veterans Parkway, your car is a mess, and you are sore. Friends tell you not to panic because “you have a year to deal with the insurance.”

That quiet line, repeated at work or over coffee, is exactly how the Florida PIP one-year deadline idea traps Cape Coral crash victims.

Florida’s rules on Personal Injury Protection (PIP) are strict, but they are not what most people think. The biggest problems usually come from waiting too long to see a doctor or to treat the claim as “no big deal.” This guide explains what the law really says, how the one-year myth grew, and what you can do right now to protect your benefits after a Cape Coral car accident.

Where Did the Florida PIP One-Year Deadline Idea Come From?

There is no Florida statute that gives you only one year to claim PIP benefits. The phrase “Florida PIP one-year deadline” is a mix of:

- Old or out-of-state information shared online

- Confusion with other insurance deadlines

- Half-true things said by adjusters or friends

To someone who is hurt and stressed, “you have a year” sounds comforting. It suggests there is plenty of time to heal, sort out the car, and then deal with paperwork later. The law does not work that way.

Florida’s real rules are a combination of very short windows and much longer ones. If you treat everything like there is a simple one-year clock, you risk missing the most important early deadline of all.

The Real Deadlines That Control Your PIP Benefits

Florida’s PIP system has several different time limits working at once. Here are the key ones that matter to a Cape Coral crash victim.

| Key rule | What it affects | Time limit |

|---|---|---|

| 14-day medical treatment rule | Whether PIP coverage applies at all | See a qualified provider within 14 days of the crash |

| Lawsuit vs at-fault driver | Most negligence-based injury lawsuits | Usually 2 years from the accident date |

| Lawsuit for unpaid PIP benefits | Suing your own insurer for denied or underpaid PIP | Often several years, not just one |

The 14-day rule is the real emergency

Under Florida law, you must see a qualified medical provider within 14 days of your car accident for PIP to apply. If you wait longer, your insurer can refuse to pay PIP benefits completely, even if you were clearly hurt.

Many Cape Coral drivers feel “shaken up” but not badly injured, so they skip urgent care or a doctor visit. By the time pain in the neck, back, or shoulder flares up weeks later, that 14-day window is gone.

A detailed Cape Coral PIP claim guide for accident victims breaks down how medical treatment choices in those first days can shape the entire claim.

Reporting the crash and opening a claim

Auto policies often require “prompt” notice of an accident. Some carriers want to hear from you within a few days, others within a short number of weeks. If you sit on the claim for months because you think you have “a year,” the insurer may argue you broke the policy rules.

You do not need to have every detail or medical bill ready to report the crash. You just need to open the claim, give honest basic facts, and then keep sending updated information as treatment continues.

Years, not months, to pursue lawsuits

Once you have met the 14-day rule and opened a claim, Florida law gives you more time to pursue lawsuits:

- Most negligence-based injury lawsuits against an at-fault driver now have a 2-year deadline for newer crashes.

- Lawsuits against your own insurer for unpaid PIP benefits usually have a multi-year time limit that works more like a contract claim.

The exact window for a lawsuit can depend on the date of the accident and the type of claim. An attorney who works with Florida PIP and no-fault claims can calculate the correct deadline for your case.

For background on how no-fault coverage and PIP fit together, see this overview of Florida’s no-fault car insurance law.

How Waiting Hurts Cape Coral Crash Victims

The one-year myth encourages delay at the worst possible time. Here are three common impacts.

1. Lost PIP coverage entirely

If you miss the 14-day medical rule, the insurer can deny PIP medical benefits from the start. That means you may end up using health insurance, savings, or debt to pay for treatment that PIP should have covered.

2. Weaker medical evidence

When you wait weeks or months to see a doctor, the insurer gets an easy argument: maybe something else caused the pain. Early treatment ties your injuries to the crash and gives your lawyer clear records to work with later.

3. Pressure to settle for less

If you delay and then try to settle near the end of a real legal deadline, you lose bargaining power. The closer you get to a hard cutoff, the more an insurer knows you might accept a low offer to avoid missing it.

Those problems stack up fast when someone has been told, “Relax, you have a year to handle it.”

Common Ways Cape Coral Drivers Get Caught Off Guard

Drivers in Cape Coral often make the same mistakes after a crash, especially when they think the Florida PIP one-year deadline controls everything.

Some typical traps:

- Focusing only on the car repair and ignoring pain until weeks later

- Trusting an adjuster’s casual remark about “plenty of time”

- Believing soreness will fade and not wanting to “make a fuss”

- Waiting to call a lawyer until medical bills are already past due

Many people are also unsure how Florida’s no-fault system works at all. They are not clear on when PIP pays, when they can sue another driver, or how serious an injury must be before a lawsuit is possible. A local breakdown of those rules is available in this guide to Cape Coral PIP claim basics under no-fault insurance.

When someone misunderstands both the system and the timeline, the odds of a costly mistake go up.

Steps To Protect Your PIP Benefits After a Cape Coral Crash

You do not have to know every statute number to protect yourself. Focus on a few clear steps.

1. Get checked by a doctor right away

Even if you think your injuries are minor, get examined within 14 days. This can be at an ER, urgent care, chiropractor, or other qualified provider. Tell them it was a car accident so that the records connect your symptoms to the crash.

2. Report the accident promptly to your insurer

Call your own PIP carrier quickly, even if fault is obvious on the other driver. Give calm, simple facts. Do not guess about injuries or long-term impact. If you are unsure what to say, speak with an attorney first.

3. Document everything from the start

Keep a folder with medical bills, visit summaries, prescription receipts, photos of injuries, and time missed from work. Strong paperwork helps your lawyer push back when an adjuster claims your treatment was “excessive” or unrelated. A helpful checklist of essential documents for a Florida personal injury attorney shows what to save.

4. Follow through on recommended treatment

Gaps in care, missed appointments, or long breaks in therapy give insurers excuses to cut off payments. If you cannot attend a visit, reschedule it. Keep a simple journal of pain levels and activity limits.

5. Talk with a Cape Coral car accident attorney early

You do not need to wait until things are “really bad” to ask legal questions. An attorney can explain which deadlines apply to your case, help you avoid mistakes with statements to insurers, and review any settlement offer before you sign.

For broader safety and claim tips after a wreck, this comprehensive post-accident guide for Cape Coral residents is a useful companion to keep in mind.

When You Should Be Worried About Time

As a practical rule, you should treat three time points as red flags:

- The first 14 days after the crash

- Any time you get mail from an insurer that mentions “deadline” or “final notice”

- The months leading up to the true legal limitation period for your claim type

If you are inside any of those windows and still handling things alone, it is a good time to get legal advice. A short call can clear up whether the “deadline” in front of you is real, flexible, or simply a pressure tactic.

Conclusion: Do Not Let A Myth Cost You Real Money

The idea of a simple, one-size-fits-all Florida PIP one-year deadline sounds comforting, but it hides the real danger. The law gives you only 14 days to trigger PIP coverage, then a mix of shorter and longer windows for the rest of your claim.

If you have been hurt in a Cape Coral crash, treat time as your ally, not your enemy. Get medical care now, open your claim, keep strong records, and speak with a local car accident attorney before you sign anything. A clear understanding of your true deadlines can be the difference between full benefits and a lifetime of unpaid bills.